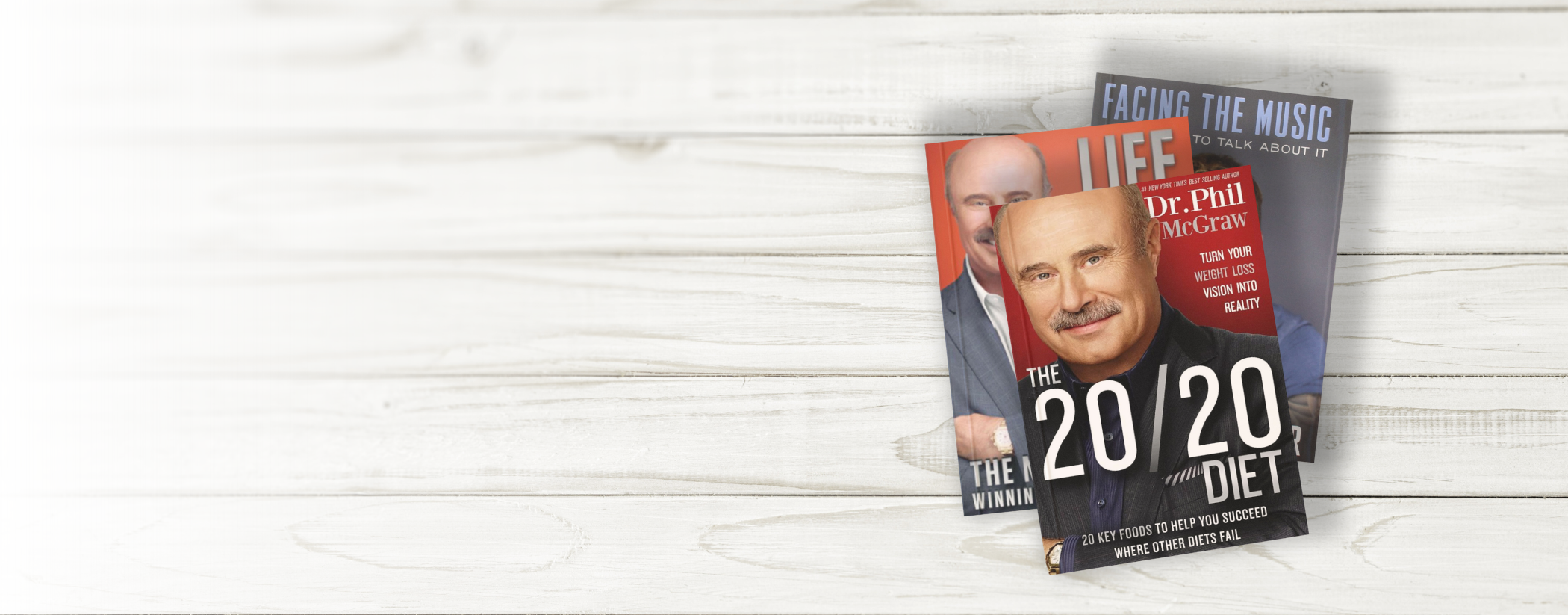

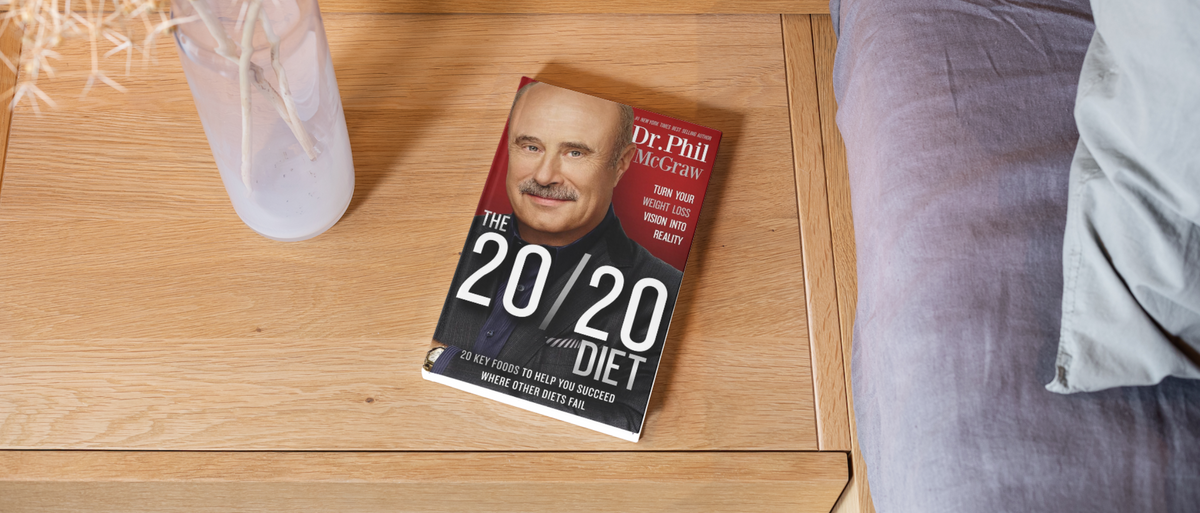

The 20/20 Diet - Turn Your Weight Loss Vision Into Reality

- Regular

- $26.00

- Sale

- $26.00

- Regular

-

Sold Out

- Unit Price

- per

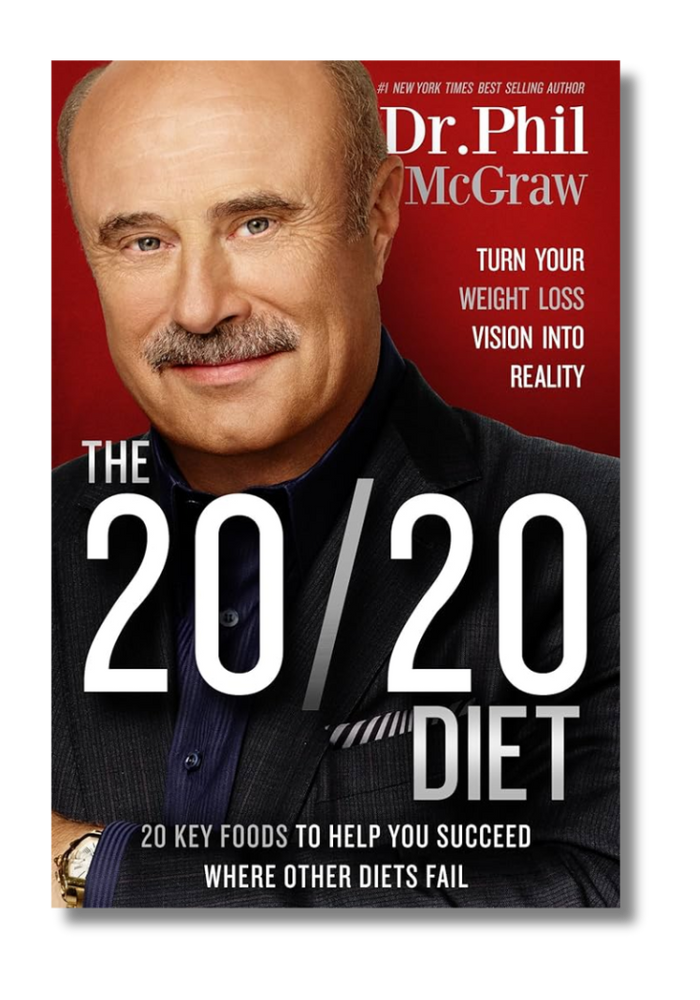

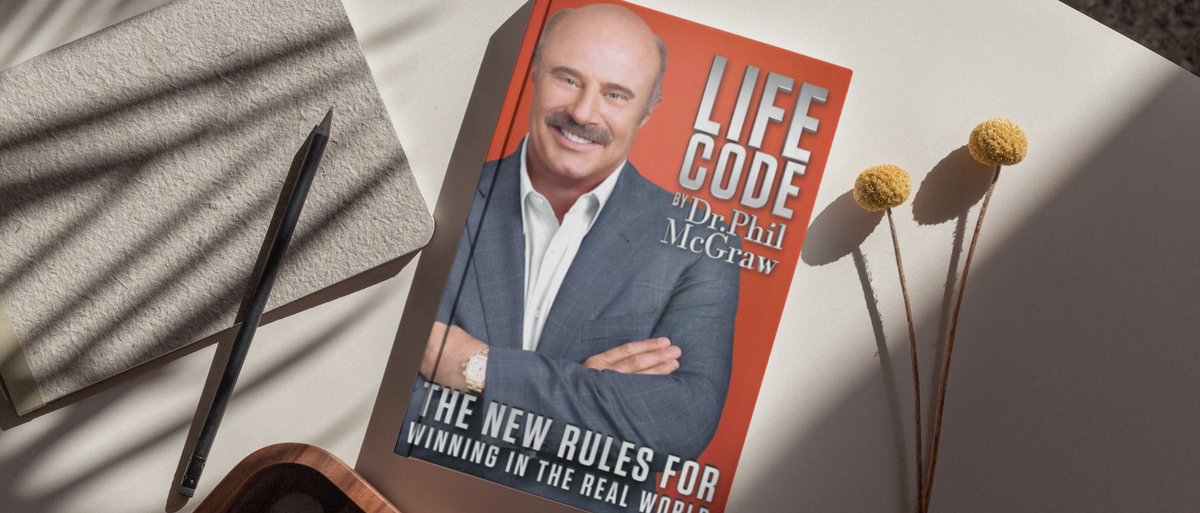

Life Code - The New Rules for the Real World

- Regular

- $26.00

- Sale

- $26.00

- Regular

-

Sold Out

- Unit Price

- per

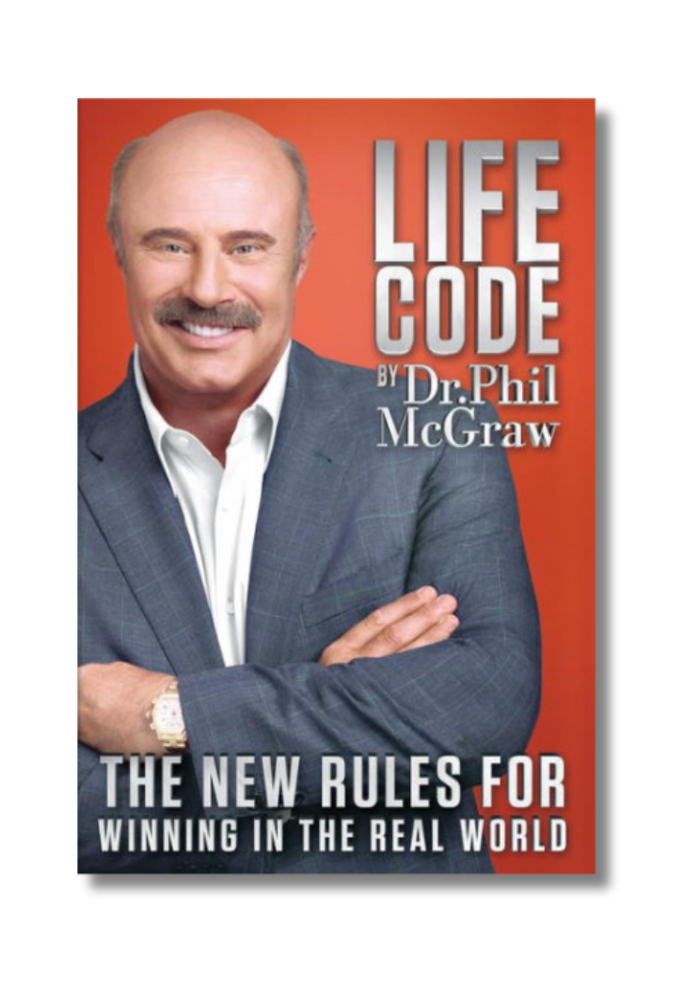

Side Effect: Skinny: Denise Austin's Fat Blast Diet

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

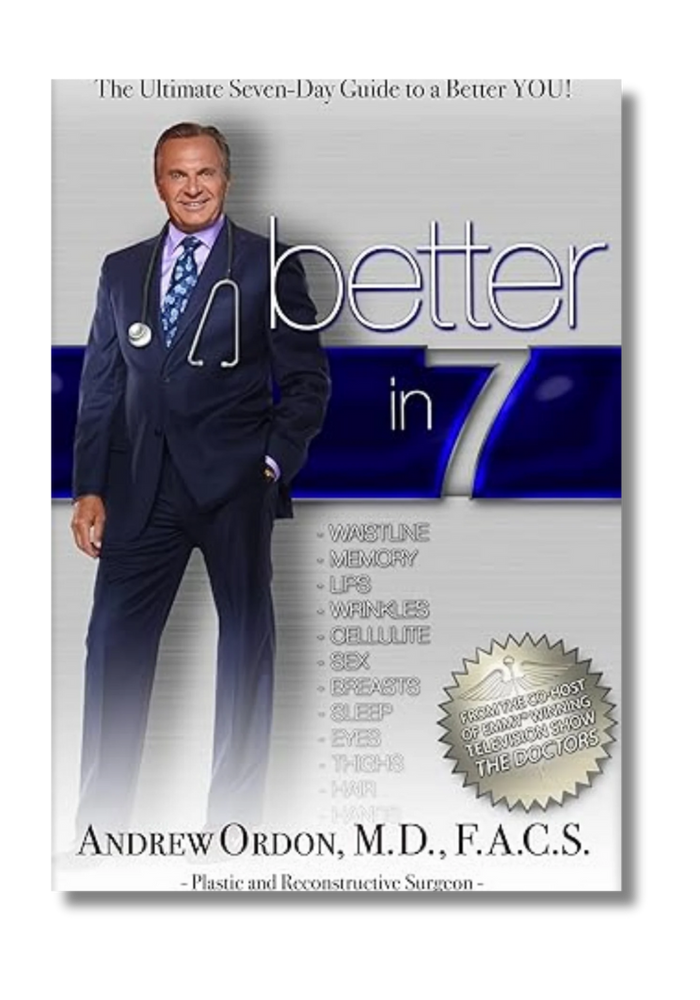

Better in 7: The Ultimate Seven-Day Guide to a Better You!

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

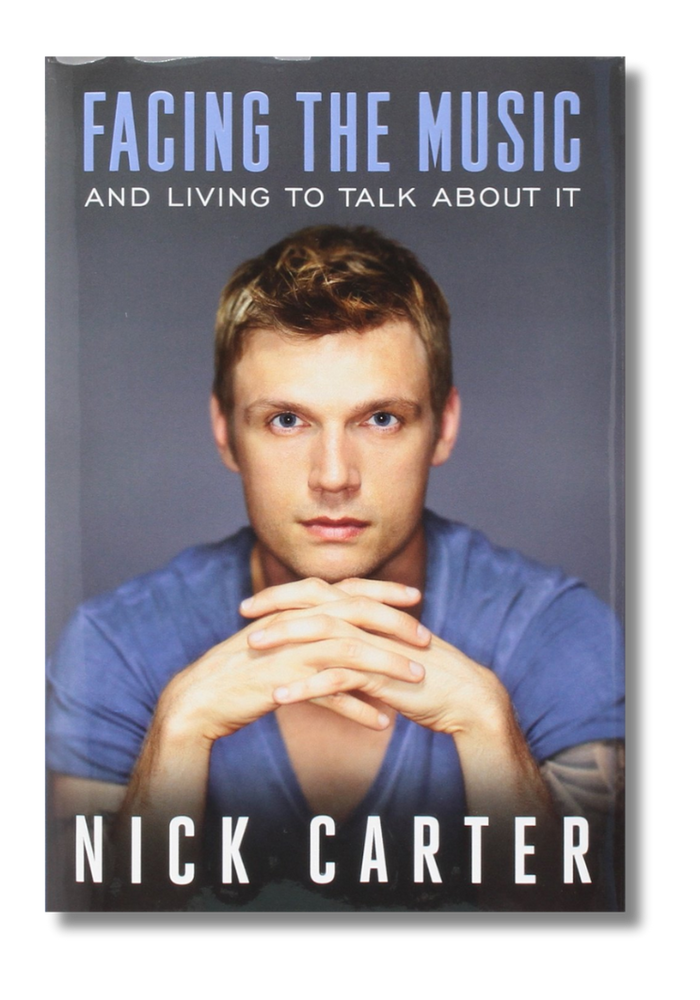

Facing the Music And Living To Talk About It

- Regular

- $28.80

- Sale

- $28.80

- Regular

-

Sold Out

- Unit Price

- per

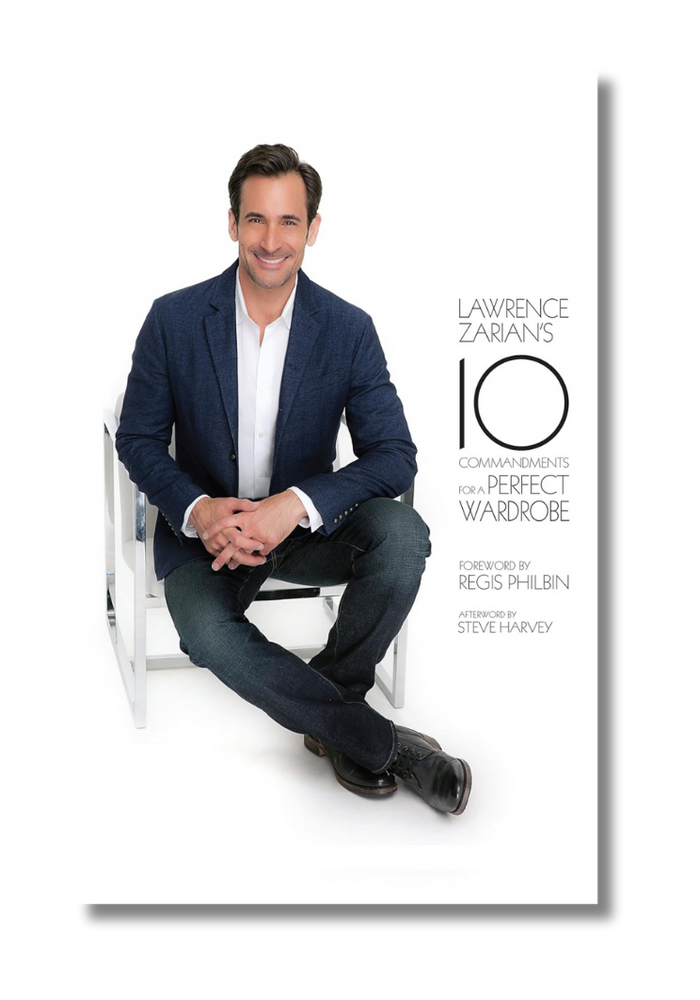

Lawrence Zarian's Ten Commandments for a Perfect Wardrobe

- Regular

- $24.99

- Sale

- $24.99

- Regular

-

Sold Out

- Unit Price

- per

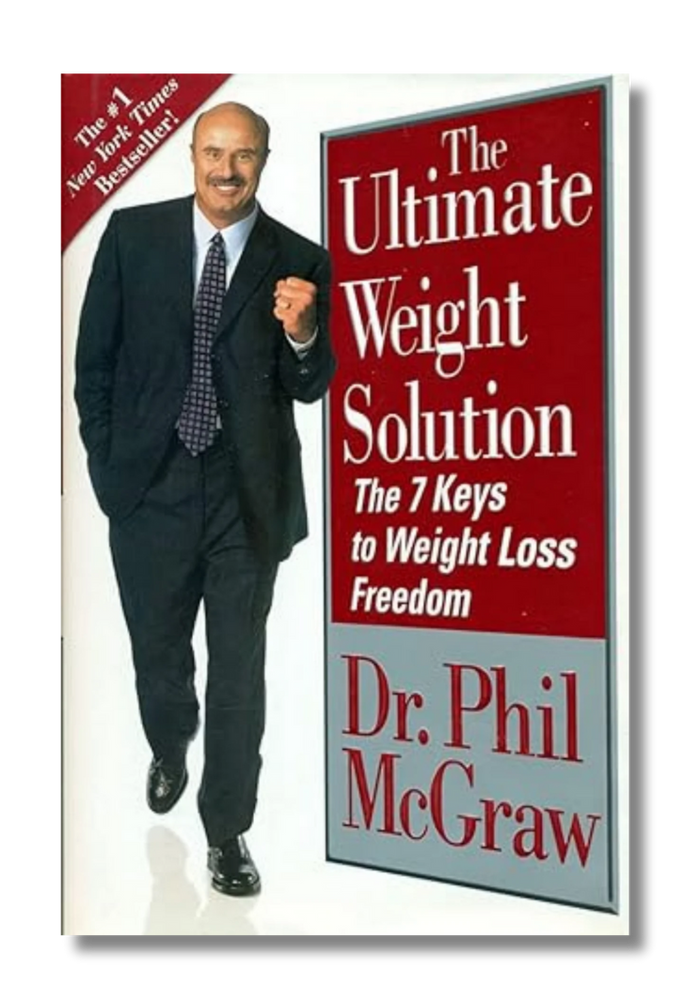

The Ultimate Weight Solution (The 7 Keys to Weight Loss Freedom)

- Regular

- $26.00

- Sale

- $26.00

- Regular

-

Sold Out

- Unit Price

- per

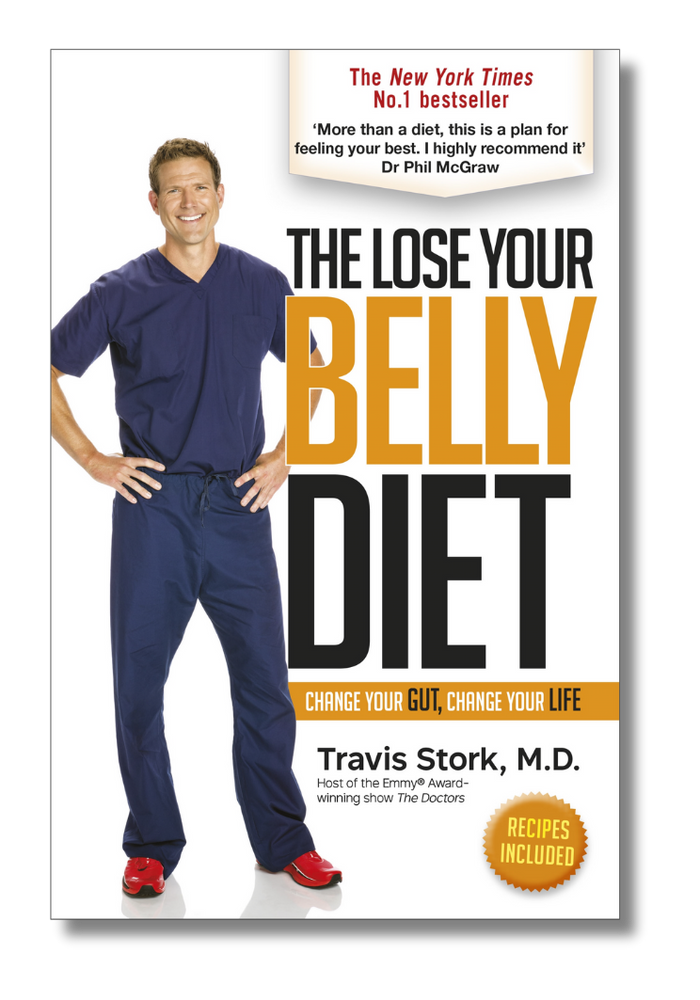

The Lose Your Belly Diet: Change Your Gut, Change Your Life

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

The 20/20 Diet

Dr. Phil and his team have created a plan that you can start following right now and continue working for the rest of your life.

The Ultimate Weight Solution (The 7 Keys to Weight Loss Freedom)

- Regular

- $26.00

- Sale

- $26.00

- Regular

-

Sold Out

- Unit Price

- per

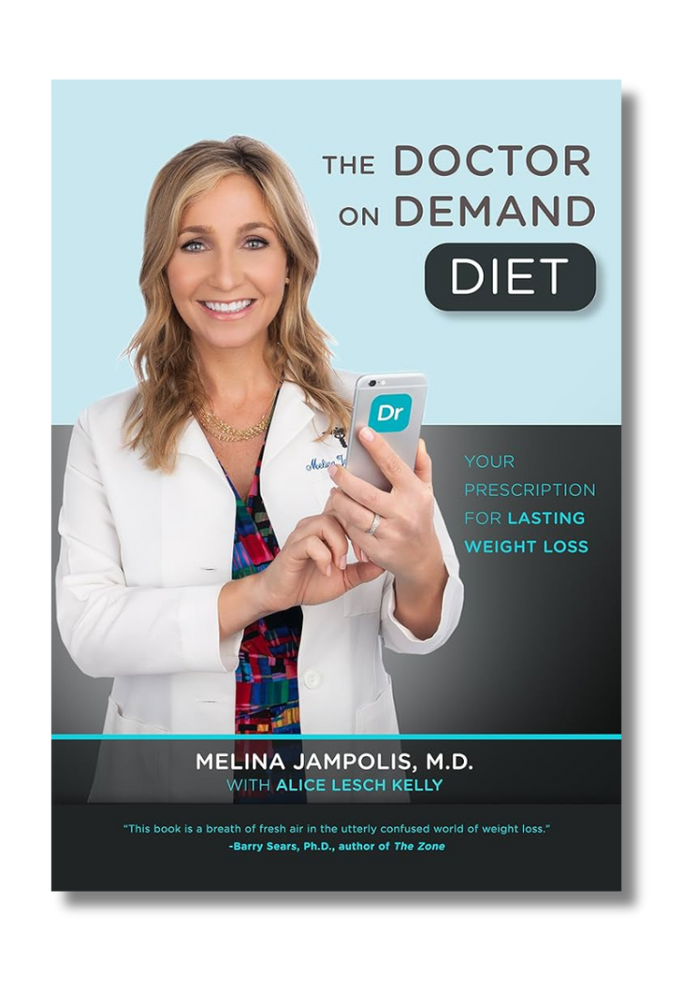

The Doctor On Demand Diet

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

The Lose Your Belly Diet: Change Your Gut, Change Your Life

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

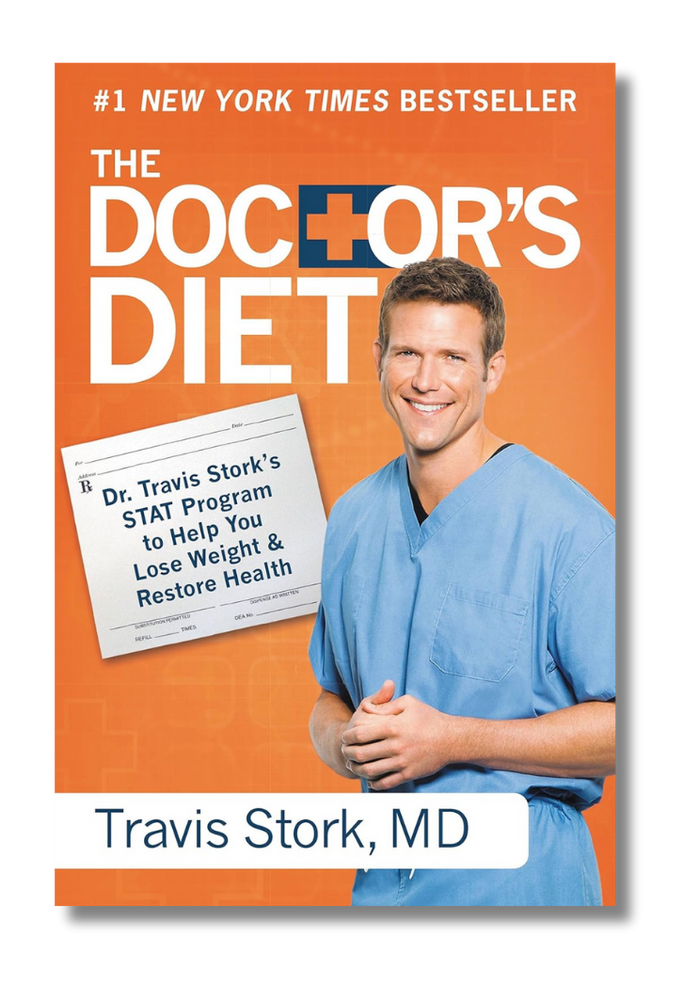

The Doctor's Diet: Dr. Travis Stork's STAT Program to Help You Lose Weight & Restore Health

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

The 20/20 Diet - Turn Your Weight Loss Vision Into Reality

- Regular

- $26.00

- Sale

- $26.00

- Regular

-

Sold Out

- Unit Price

- per

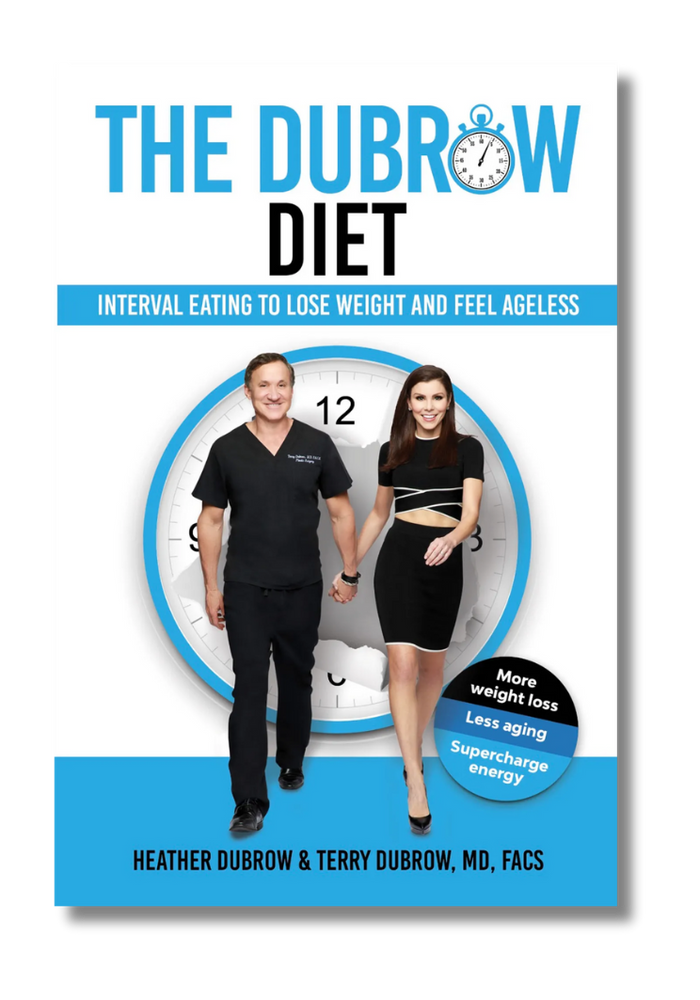

The Dubrow Diet: Interval Eating to Lose Weight and Feel Ageless

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

Side Effect: Skinny: Denise Austin's Fat Blast Diet

- Regular

- $25.95

- Sale

- $25.95

- Regular

-

Sold Out

- Unit Price

- per

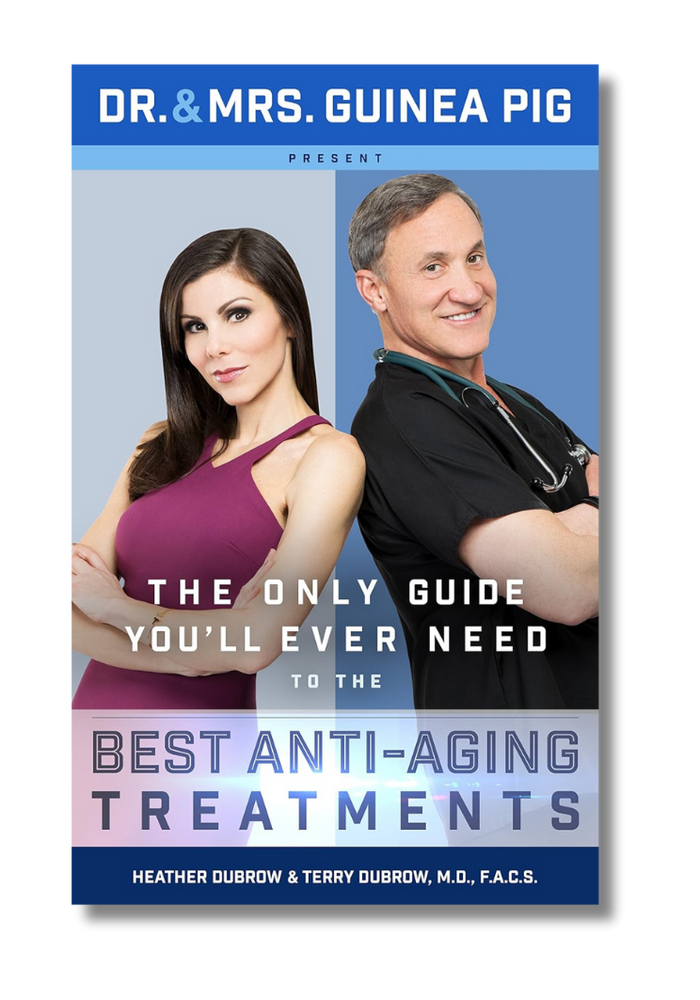

Dr. and Mrs. Guinea Pig Present The Only Guide You'll Ever Need to the Best Anti-Aging Treatments

- Regular

- $26.00

- Sale

- $26.00

- Regular

-

Sold Out

- Unit Price

- per

Books by Topics

Life Code - The New Rules for the Real World

Challenging, yet informative, this book will help you gain the skills and confidence to get what you deserve.